Unpaid rent doesn't have to be a dead end.

BureauEdge helps property managers use the same credit reporting infrastructure as banks and credit card issuers — improving rent collection and creating real accountability without changing your workflow.

Run your rental portfolio like a credit card or mortgage

Link your lease to your tenant's credit report and history just like a credit card or mortgage. Every lease becomes a tradeline in their credit history.

On-time rent builds real credit

How It Works

- Rent creates a continuous credit tradeline on a resident's consumer credit report

- Payments are reported monthly to major credit bureaus

- Outstanding balances and payment status are visible to future lenders and landlords

- Consumers must give consent to the credit building - see our addendum template to get advance consent

Impact

- Attract reliable residents willing to tie their rental payments to their credit report

- Residents build credit with every on-time payment

- Rent becomes financially accountable, not informal

- Payment behaviour improves because credit is at stake

Serious arrears carry real consequences

How It Works

- Collections tradeline is created when you decide that negotiations for repayment are not working

- Severe arrears can be reported with a court order and without a court order

- The collections tradeline is visible to downstream lenders and decision-makers for up to 6 years

- Consumers do not need to give consent in situations of bad debt

Impact

- Credit scores are negatively affected

- Accountability follows the tenant beyond the lease

- Incentivize repayment of arrears even after the lease ends

Designed for responsible reporting

BureauEdge is built to reward positive payment behaviour first. Collections reporting is gated, documented, and verified to ensure accuracy, fairness, and compliance with credit reporting standards.

How It Works

Three simple steps to supercharge your rent management workflow

Sync your leases to Openroom

No double entry. We plug in to your property management software and automatically sync your leases and payment history. If you don't use any software, we have a custom import workflow made just for you.

You decide who to reward

You can control which residents are eligible for credit building and perks. Open a tradeline for all of your lease or only for those you want to reward.

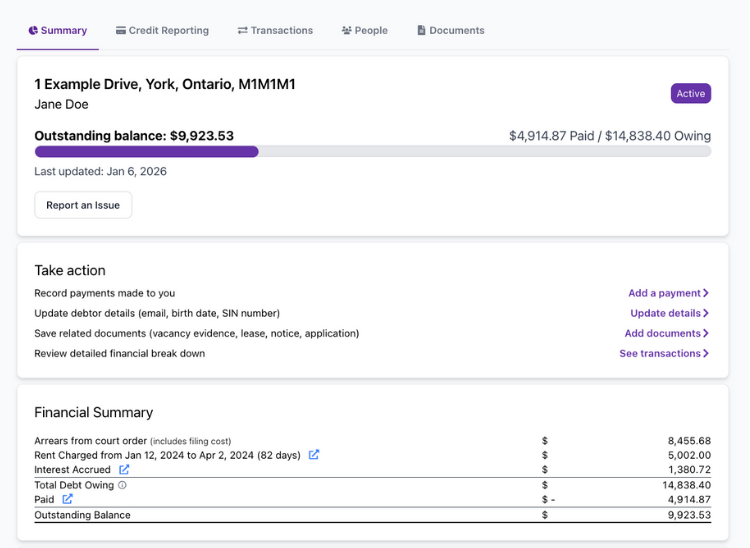

BureauEdge Dashboard

You decide when to escalate

When rental arrears are starting to get out of control and negotiations are not working, you decide when to add a collections line to your resident's consumer credit report

Rental Debt Ledger

Automated Credit Building For Your Residents

- Every on-time rent payment automatically reported to Equifax

- Help residents build credit history while they rent with you

- Increase resident retention with tangible credit benefits

Perks & Rewards Program

- Access to hundreds of exclusive perks for your residents

- Discounts on moving, insurance, entertainment, and more

- Incentivize on-time payments with tangible rewards

Unlimited Severe Arrears Escalation Without Court Order

- Report current residents 4 months past due, to Equifax, without a court order

- Report former residents who left with outstanding debt but you didn't take to court, to Equifax, without a court order

- Beyond rent, this works for utilities, storage, parking, and any other fees agreed on

Unlimited Rental Debt Ledger Filings With a Court Order

- File your Tribunals or Court Orders with rental debt in the last 6 years as a collections line on Equifax

- File becomes searchable within the Openroom Public Record Search engine

- Keep all of the money you recover - no commissions

All in one pricing

Designed for property management teams operating 30 to 5,000 units

Annual subscriptions that scales by number of managed rental units

Everything included:

Get a quote based on your portfolio size

Common Questions

Transform Your Rent Management Today

Join hundreds of property managers who have streamlined their workflow, improved tenant retention, and recovered rental debt with Openroom's BureauEdge services.